The time has come to sell your ecommerce business. You want to get maximum value and you’re deciding how to prepare. There is a lot to think about when you’re getting ready to sell and in this post, we’ll cover them all to maximize the price you receive.

Let’s jump right in.

What is your ecommerce business worth?

Some common questions to ponder when selling your business are as follows:

- What is your market position?

- What systems and processes are in place to run the business?

- What are the sales?

- What is the profit?

- What are the growth trends?

- What is driving new sales and is that sustainable?

- What channels do new customers come from and what is the breakdown of each channel?

- How reliant is the business on the owner?

There are a few external factors at play here as well. An ecommerce business’ value is is relative to the state of the market, the individual business, and what potential buyers are willing to pay.

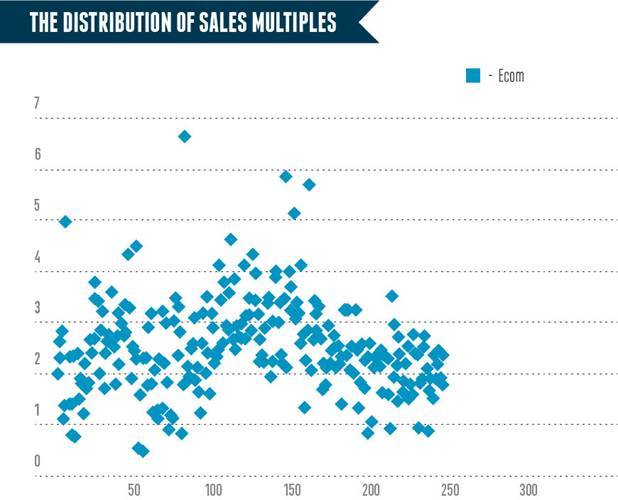

Part of the valuation process is comparing your business to historical sales of similar ecommerce businesses. The following graphs represent 245 sales with a total transaction value of $117 million (sum of all the businesses) between 2010 and 2014.

Pay special attention to the 2.51 average multiple, which is easily the most important piece of data in the graphic. This is the average multiple of yearly profit for which the average business sold. For example; if a business sold for $250,000, with a multiple of 2.51, that means that the business was making close to $100,000 in profit per year ($250,000 divided by 2.51)

A commonly held belief is that a small to medium business sells in the 2-3X valuation range. In this graphic, the multiples range from 0.5X to 6.6X. This means if you have a business that makes $100,000 in net profit per year, the valuation range is from $50,000 to $660,000. Visually what you can see from the graph is that most businesses sell between the 1.5X – 3.0X range. So the data support the common hypothesis.

What makes an ecommerce business worth more?

The higher the risk, the less the buyer will be willing to pay and vice-versa. Thus, the amount a buyer is willing to pay for your ecommerce business will all come down to one ratio: return-on-investment (ROI) compared to relative risk. You can lower the risk of the business failing in the future by ensuring that your online store has all of the following characteristics, making your ecommerce business worth more:

- Growth potential

- High percentage of repeat sales

- High percentage of repeat visitors

- Stable or growing traffic from a variety of sources

- A long history of traffic stats from a reputable source such as Google Analytics

- Predictable key drivers of new sales

- Established suppliers of inventory with backup suppliers in place

- Clean legal history

- Brand with no trademark, copyright or legal concerns

- Documented systems and processes facilitating operations

What does the average ecommerce business sell for?

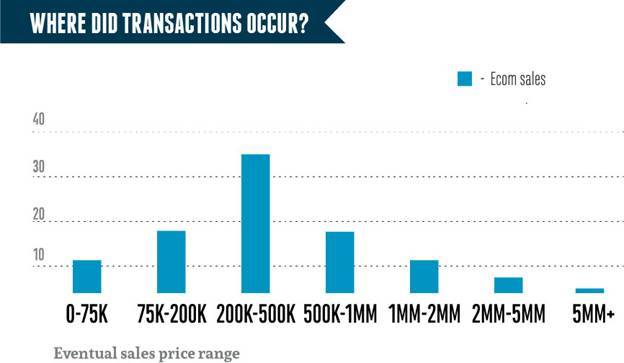

Ecommerce businesses can sell for as little as a few thousand dollars to hundreds of millions. This graph shows the data we analyzed which are typically businesses in the $100,000-5m revenue range. However, don’t worry if you have a smaller business than this. We discuss tactics and places to sell a smaller ecommerce store as well in this post.

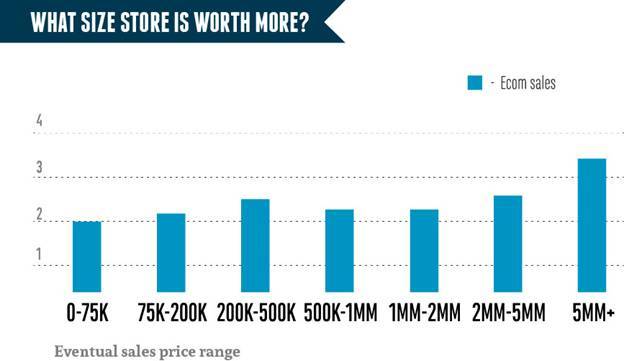

Are bigger ecommerce businesses worth more?

In general, the larger the ecommerce business, the more that it is worth. Here is how you understand the graph above. Let’s say that a business sold for $130,000. On average that would mean that its yearly profit was $65,000 ($125,000 divided by 2). Another example would be a business that sold for $525,000. On average that would mean that it’s yearly profit was $218,750 ($525,000 divided by 2.4). Similarly, a business that sold for $2.75 million would have a yearly profit of approximately $1.05 million ($2.75 million divided by 2.6)

When is the best time to sell your business?

Like any other major life decision, there is no “perfect time” to sell your business. Sometimes you are forced to sell because of external circumstances; sometimes an offer comes along that you just can’t pass up. However, for our purposes here, the best time to sell your ecommerce business is when there has been sustainable growth. Growth is tracked in yearly increments. Let’s take the following example:

- Year 1 – $125,000

- Year 2 – $350,000

- Year 3 – $725,000

- Year 4 – $625,000

In the above example, the best time to sell would have been late in year three. Once business starts to decline, the size of the offers you receive can be significantly impacted.

How does the selling process work?

In general, most sales will follow the structure below:

- You decide to sell the business

- You get a valuation (like an appraisal when you sell a house, this is a summary of what the business is worth)

- You develop a prospectus (a legal document which contains all the facts and figures about your business)

- Find potential buyers for your business (whether you use a broker or sell it yourself)

- Negotiate with potential buyers (total price and also terms of the deal)

- Transfer the assets and money

- For a time, work with the buyer to train them on how to run the business

How long will it take to sell your business?

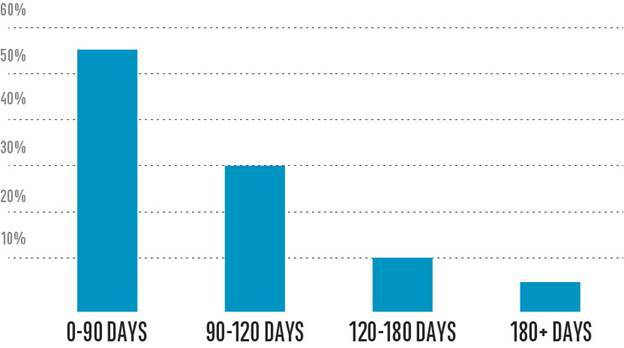

Generally, larger deals ($1 million and more) will take longer to sell than smaller deals ($200k or less) because of the complexity of the business and also increased risk on the buyer’s part. If your business is a micro business (under $50k), it might only take a week or two to sell privately on a marketplace like Flippa. That said, the time it takes to sell an ecommerce business does depend on individual business and terms of the deal.

The graph below represents the summary of all the deals that we have completed and the time it took to complete them on average. As you can see, the majority of deals close within 3-4 months.

Where can you sell your business?

Small Business Marketplaces – best for smaller businesses (under $100k) – Smaller business and micro-businesses are usually best sold privately by the owner through forums or classified websites.

To sell your small business, check out:

- Flippa – without a doubt, the best marketplace for buying and selling small ecommerce businesses

- SitePoint Forums – the original place that you could post your website for sale before flippa.com

- Warrior Forum – one of the original internet marketing forums; a great place to find potential buyers for your business

- Shopify Forum – another good place to sell a small ecommerce business

- Experienced People Forum – a forum about buying and selling websites

Broker – best for medium businesses ($100k – $5m) – Medium sized businesses in the $100k-$5m are best sold through brokers who help with finding buyers, as well as negotiating and structuring the deal.

To sell your medium sized business, check out:

Investment Banks – best for large businesses ($5m +) – Larger businesses are best sold through merger and acquisition companies or investment banks.

To sell your large business, check out:

- Founders Investment Banking – a great option if your business is making over $3m dollar profit per year.

Who will buy your business?

There are a lot of potential buyers on the market for ecommerce businesses. Through experience, many buyers fall into one of the following types:

- Established Brick and Mortar Entrepreneurs – Brick and mortar entrepreneurs may have exited and are looking to sell online exclusively, or they may still own their company and are looking to expand their online offerings.

- Private Equity Companies – Usually, their interest lies with larger businesses. These are companies that look to keep the existing management in place and grow the business through varying sizes of corporate share packages.

- Media companies – Similar to private equity companies but they have more of a focus on digital companies and media. A large public example is Demand Media’s recent ecommerce acquisition.

- Established Internet Entrepreneurs – Individuals who have been in the industry for a while and have a good understanding as to what it takes to run a digital business. They are either fresh off the sale of their last business or looking to add a business to their portfolio.

- Corporate Guy – Usually a high paid employee or C-level executive with disposable cash, IRA, savings or access to an SBA loan. This is someone looking to buy his or her first business.

- Baby Boomers – As the “baby boomer” generation retires, a group of new tech-savvy individuals has risen. These people are usually looking for new investment opportunities as new projects or ways to fund their retirement.

Why do buyers say “No”?

Sometimes a sale falls through or a buyer says “No.” Some common reasons include:

- Financial, branding or product condition of the business

- They don’t like the business

- They don’t like the niche

- Issues with transferability

- Something wrong with that stats or data

- A buyer finds something that makes them reconsider their offer

- Seller wants more money than buyers are willing to pay

- Trends with particular business or market

- Or maybe the funding for the buyer just falls through

Tips On Getting The Best Deal And What To Avoid

When deciding to sell your ecommerce business, consider the following tips to ensure to receive maximum value and offers:

- Sell your business when you are still growing to ensure you you get the highest valuation and sales price.

- Seller financing offers typical receives a higher overall selling price.

- That said, deal terms matter much more than total price. For example you could sell your business for $1 million to one buyer and finance the wholesale and risk not having the repayments being made OR you could sell your business for $850,000 and receive it all in cash up front. Personally, I would almost always choose the cash.

- Competition helps. Having multiple offers not only increases your chance of closing a sale, it also helps raise the offer of other parties looking to obtain the deal over their competition.

- Use anchoring in your negotiations. Start at a higher asking price and negotiate down. Make sure everyone feels they win the negotiation. Remember, you will have to work with this person for a period after you sell, so the buyer can learn how to run the business.

- Be patient, especially during the negotiation process. Pushy selling and sales tactics do not work when selling a business.

- Document everything in the purchase agreement. Everything that you have negotiated needs to go down on paper. You will have no legs to stand on if trouble starts to happen in the deal and you have only a verbal agreement on something. Remember, judges can only rule on what they can see.

- Be aware that the offer might change after the due diligence period. The value of your business can go down in due diligence if the buyer notices problems in the business. Therefore, it is best to be upfront about potential problems early in the negotiation period. Even so, the buyer still might want to make changes after due diligence.

Conclusion

The decision to sell a business isn’t always easy for entrepreneurs. No matter the reason for the sale, there are multiple options for you to find a buyer and sell your business. Following the tips in this post will put you on the right track to receiving maximum value for your business.

About The Author: Elizabeth writes for Digital Exits. If you are looking to sell your ecommerce business they offer a free valuation service here.

Elizabeth,

I use to sell on Flippa, sitepoint,warriorforum but hearing shopify for first time. Will give that a try