Mutual funds are an amazing investment instrument, so pay attention. This will play a key role in your financial freedom.

If you are like most people, you do not know enough about the economy, nor have the inclination to learn and stay on top of the market. Even if you do, as a retail investor sitting at home with a laptop, information available to you is limited.

This is where mutual funds come in. Here is a simplistic picture of how they work.

- Mutual funds are created by large fund houses called Asset Management Companies (AMC).

- These fund houses hire financially talented (or at least we hope they are) individuals and assign them as fund managers.

- AMC’s pool funds from the general public and the fund managers invest them to earn a profit.

- AMC’s distribute the profit back to it’s investors after deducting a percentage as their share. (This deduction is called expense ratio, anywhere between 0.1% and 2.5% depending on the mutual fund.)

Types Of Mutual Funds

There are over 1700 mutual funds in India, but for our discussion we can broadly classify them just like we classified the investment opportunities in India.

- Debt Mutual Funds – Mutual funds that invest in fixed income instruments like government bonds. Depending on the fund, the risk is generally lower and returns are close to fixed deposit returns. This is my favourite alternative to fixed deposits and we will cover them in detail in a future dedicated article.

- Equity Mutual Funds – Funds that primarily invest in stocks and shares of companies. Risk is high and comes with a potential of higher return. This is a good starting point for the equity part of your portfolio.

- Equity Linked Savings Scheme (ELSS) – A special kind of equity mutual fund which provides tax benefits under section 80C of Income Tax laws. Section 80C allows deductions of up to 1,50,000 INR and this can be claimed by investing in ELSS. There is a lock-in period of 3 years for the invested amount.

Each of these are sub-categorised and it gets very complicated. We will cover some of them in the future to help you get started. As you learn more, you can discover the others on your own.

Are Mutual Funds Safe?

The right question should be, “what are the risks” involved. No investment is 100% safe.

Mutual Funds are regulated by SEBI and they (hopefully) do everything in their power to protect retail investors like you and me.

Investing into a mutual fund is like buying groceries from a super market. There are 1700+ options. Even from the same item, there are good apples and bad apples. You need to educate yourself to find the good apples.

I will write about my strategy on choosing mutual funds in the future.

Debt mutual funds are safer than equity mutual funds because the underlying instruments are less volatile. However returns are also lower and might not even beat inflation in the long run, so exposure to riskier equity mutual funds is required.

Basic Mutual Fund Terminology

- NAV or Net Asset Value. Mutual fund is sold as a unit and this is the price of one unit of the mutual fund. NAV is derived from the value of the underlying assets. For example the NAV of an equity mutual fund will increase when the stocks the mutual fund is invested in appreciate in value.

- AMC is asset management company. Example Parag Parikh Financial Advisory Services Limited or Aditya Birla Sun Life Asset Management.

- Expense Ratio. This is the fees charged by the AMC for their expenses and profit. Typically between 0.1% and 1.5% but can be up to 2.5%. SEBI has mandated various limits depending on the type of the fund and the total money managed by the AMC (called asset under management).

- Entry and Exit load. This is the fees charged when you buy into the fund and when you exit the fund. Never seen a fund with an entry load, but exit load can be up to 1% if you exit within a year. Debt mutual funds typically do not have exit load after the 7th day.

- Growth (G) option and Dividend option. Funds will offer to provide monthly or quarterly dividend. Growth option reinvests the profits back into the fund. When you are trying to grow your wealth, always go for the Growth option.

- Regular funds and direct funds. Every fund comes as “Regular” and “Direct”. Both are the same fund, managed the same way. Only difference is that Regular funds are bought through a broker. The brokerage is added to your expense ratio. Always buy direct!

Start Your Investment Journey With Mutual Funds

Mutual funds provide an excellent starting point for a beginner investor. You can start with as low as 500 INR.

If you are young and is just starting your investment journey, invest your time and effort into learning more about mutual funds.

Always Buy Direct

We discussed before, a “Regular” mutual fund is when you buy the fund through a broker. “Direct” is when you buy directly through AMC website or other providers (like Coin by Zerodha or Groww) with no brokerage fees.

I personally buy from AMC websites directly. If you use Coin, you need a Zerodha account as well. Here is my referral link.

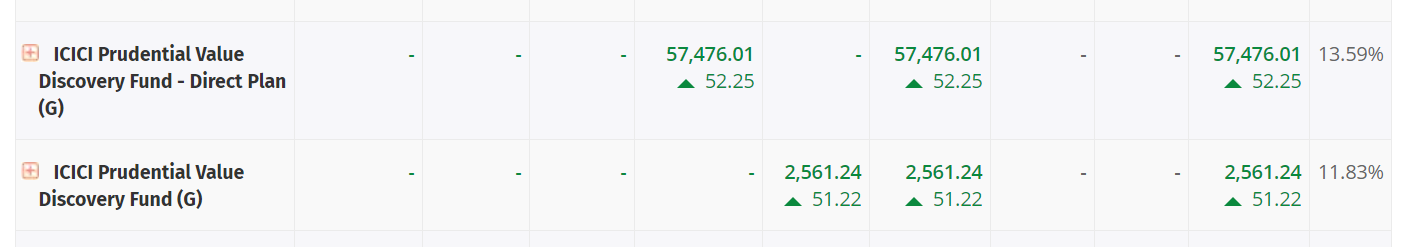

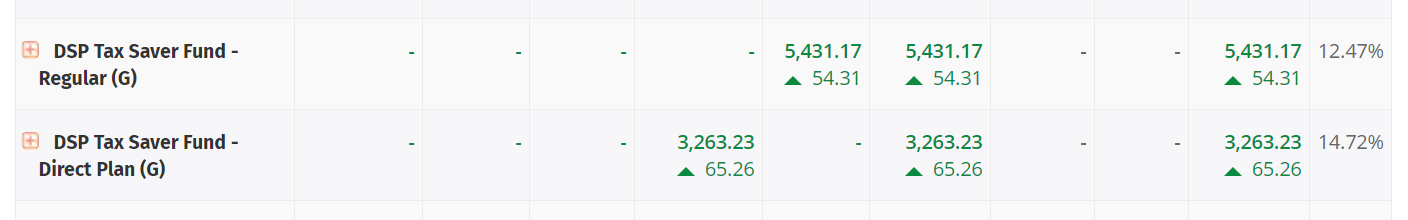

Why should you buy direct? I started buying regular. Here is a comparison of XIRR (total return converted to annual return so that it’s easier to compare against FD returns or inflation).

The right most column is XIRR. Note how “Direct Plans” have higher XIRR? Funds were invested at around the same time.

Direct funds simply give better returns. In a 30 year investment horizon, the higher expense ratio of “Regular” funds is going to make a considerable difference in your total returns.

SIP v/s Lump-sum Investment

This is an age long debate. You can do your research for a whole day and you would still be left with graphs that you are trying to decipher.

SIP is systematic investment plan. You invest a fixed amount each month either automatically or manually. I prefer to do it manually so that there are no surprises.

Lump-sum is when you invest a chunk of money into a fund in one go. I did a lump-sum investment when markets crashed last year. Unless there is a market crash, or you know what you are doing, it’s best to SIP.

Sometimes what we think we know for sure is what brings trouble. So be careful. Markets always win unless you are “the big short“.

How Many Mutual Funds Should I Invest In?

I think a good portfolio needs to have a total of 5 mutual funds spread across various AMC’s.

Investing in multiple AMC’s reduces credit risk. Not all of them will default hopefully. Ideally no one will, but we are being careful.

- Two of these funds can be debt mutual funds.

- One of these funds can be an index fund. (An index fund invests in all the equities that an index follows. Most popular indices in India are Nifty and Sensex. We will discuss index funds in depth in future.)

- One or two of these funds can be a flexi cap or large cap fund. (Flexi cap fund invests in small cap, mid cap and large cap industries. Large cap fund invests only in large cap industries.)

- If you wish to use mutual funds for tax saving, one ELSS fund should be enough.

- It’s best to stay away from thematic funds unless you know what you are doing. Thematic funds invest in a specific theme. Example: MNC fund which invest in multi-national companies.

Since most fund managers will invest in similar stocks, there will be considerable overlap. Even large cap and index fund will have overlaps.

So buying more funds will not help you with diversification. Instead your portfolio will be cluttered.

Leave a Reply