Owning and operating a car is an expensive proposition and I hope we don’t have to argue about that. Fuel costs, maintenance, insurance, taxes and tolls are all very evident.

Then there are hidden costs like depreciation and opportunity costs. Let’s take a few conservative assumptions are do a little “car math”.

Assumptions:

- On road purchase price of the car including insurance, road tax and everything: 13L (13 lakhs)

- We are buying with liquid cash, not financing.

- Annual insurance and basic maintenance: 10,000 INR. (Most car owners will laugh at this figure. We are being conservative, remember?)

- Years of ownership: 15 years.

- Running costs: 7 INR per km. (This will only go up as fuel prices increase!)

- Resale value at the end of 5 years: 4L.

Car Math

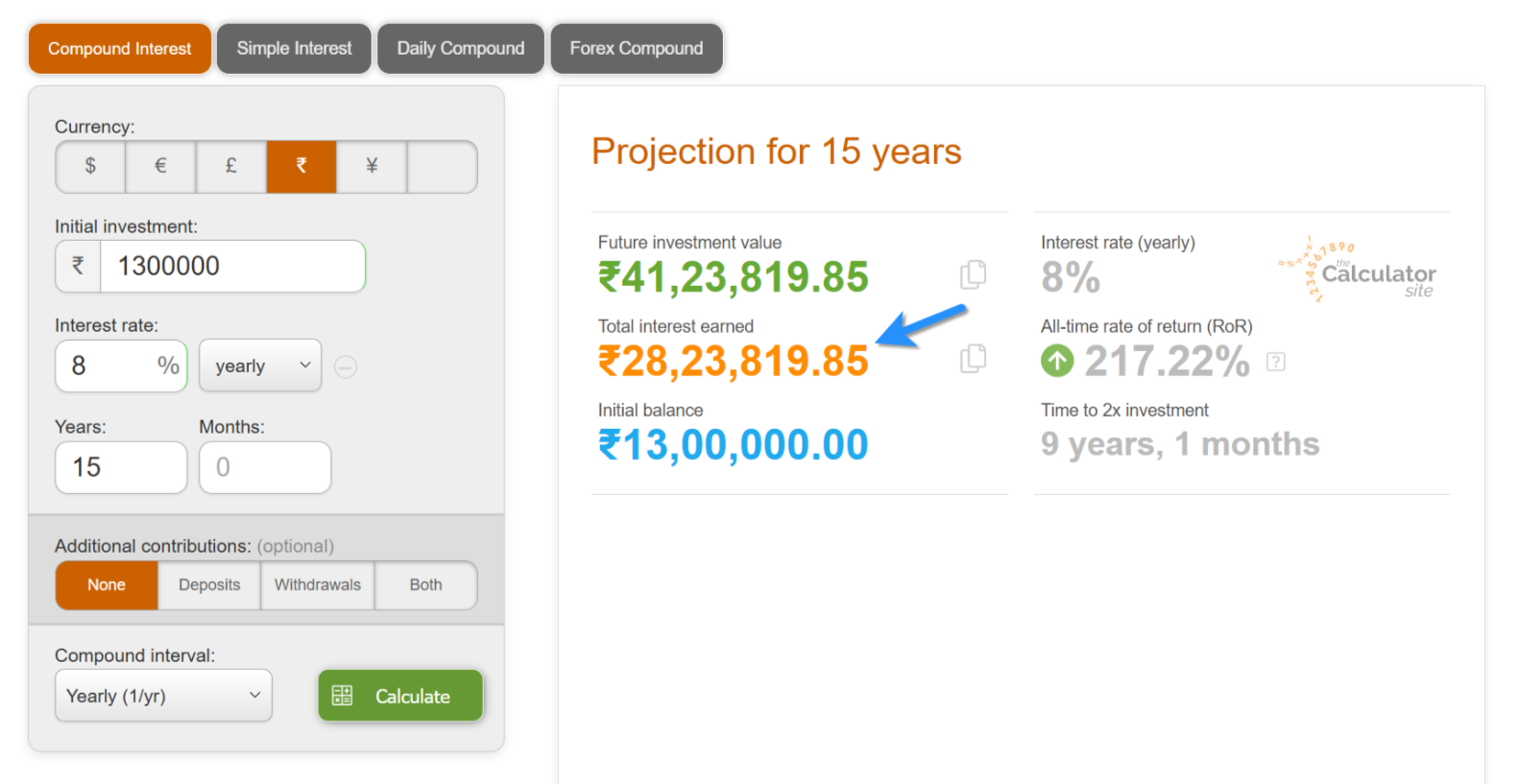

First, let’s calculate the future value of 13L that we are giving up by spending that money today. In other words the money you would have made if you had invested the principal cost of the car (13L in this example) for the period of ownership of the car (15 years in this example).

To do that math, let’s assume that your entire portfolio generates a conservative 8% annual return. If we input our numbers into a compound interest calculator, 13L at 8% annual return will come to just over 41L in 15 years. That’s a gain of over 28L!

Let’s consider two scenarios, one where you drive 5000 kms a year and the second where you drive 12000 kms a year:

- Over 15 years, 5000 x 15 = 75000 kms and 12000 x 15 = 1,80,000 kms.

- Based on our assumption of 7 INR per km, this will cost 5,25,000 INR and 12,60,000 INR respectively.

Adding it all up:

| ITEM | COST |

| Cost of the car. | 13L |

| Future value of principal. | 28L |

| Insurance, maintenance costs (10,000 x 15). | 1.5L |

| Running costs. (5000 km pa / 12000 km pa) | 5.25L / 12.6L |

| Buy back value of the car to be deduced from costs | -4L |

| Total cost of ownership | 43.75L / 51.1L |

| Total cost per KM (i.e. Total cost / total kms driven) | ~58 INR / ~28 INR |

We can get more intricate with this math if we add the interest lost from running and maintenance costs. Then on the flip side, not having a car also comes with it’s own share of expenses (bus, auto, taxi etc.) and we have to deduct that.

Did I miss something? Please do let me know.

If you observe closely, the major chunk of the costs come from just owning the car and not from the running costs. In fact, driving the car more only makes the math better as you can see above.

If you have already purchased a car, it makes more financial sense to use it as much as possible. You are essentially spending ~85% / ~72% of the total cost of ownership right when you purchase the car. You are not saving much by driving less.

Now, should you buy a car?

If you can justify the cost, and if you want one, you definitely should. A car is a major lifestyle upgrade and a good way to create lasting memories. The feeling of being in control and being able to move at will is a major luxury.

Just know what you are paying for it and see if it is worth it for you today.

Do not get a car just because you think someone of your age or career should have a car. If you do not need a car regularly, then consider opting for taxis or short-term rentals when necessary.

Leave a Reply